Shipping personal effects overseas would be a big concern while moving abroad. Be it relocation, shifting for work or education, getting your personal effects safely to the destination country does involve certain procedures and regulations.

Here is where personal effects international shipping assists people in shipping daily personal possessions like clothes, books, and household products across borders. Personal effects shipping to India is similar to other countries like the USA, UK and Canada, but it has some unique formalities.

India is one of the popular destinations in terms of international shipping of personal effects, as thousands of students, professionals, and families move every year. Approximately 916,000 Indian-born people reside in Australia, which makes it 3.4% of the total population.

This guide will explore what is personal effects shipping to India, from customs regulations to the costs involved.

Understanding Personal Effects Shipping Internationally

What Is a Personal vs Commercial Shipment

Understanding the meaning of personal effects is important for shipping personal effects internationally. Used personal belongings, such as clothes, footwear, books, and electronics, are termed personal effects.

A student shipping winter clothes and studying materials to India before joining a university would be a good example of personal effects shipping. Commercial shipments, on the other hand, are items for which a resale or business profit is expected.

The distinction is important since the customs authorities have different approaches to personal and commercial cargo. This difference between the two has an impact on the documentation you will be required to fill out, the nature of clearance and the costs of duty.

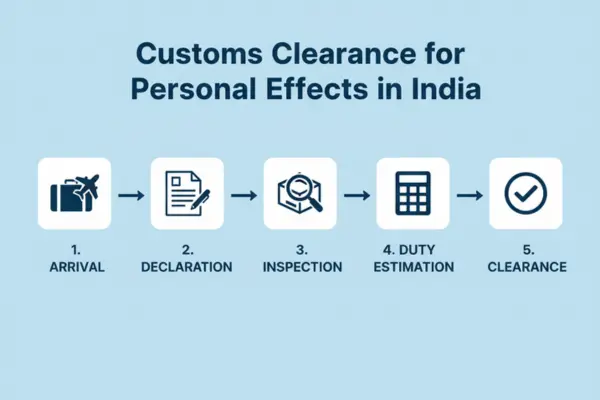

Customs Considerations for Personal Effects Shipping into India

India enforces passengers and expats to report goods on entry points and abide by certain laws related to unaccompanied personal effects. Duties or restrictions may be applied to goods that fail to meet the requirements.

Another factor is valuation. It is also common with customs officials to estimate duties even when the goods are not new. To prevent any surprises, it is advisable to hire experienced personal effects shipping companies that have expertise in Indian customs clearance.

Essential Documents for Personal Effects Shipping

Standard Paperwork

Documentation plays a crucial part in personal effects international shipping. Below is a list of common documents required:

- Detailed packing list: List and short description of everything in your shipment.

- Passport copy: Proof of identity and nationality.

- Visa copy: Required for students, professionals, or long-term travellers.

- Airway bill or bill of lading: Proof of shipment details.

- Receipts for valuable items: Useful for customs valuation and insurance purposes.

Such documents are not always necessary, but they can help to avoid possible disputes. A dependable shipping company can assist in making sure all paperwork is correct.

India-Specific Forms and Permits

There are additional guidelines relevant to shipping to India, developed by the Indian customs authorities. And these guidelines change according to the type of product. Some of the common items and their regulations are given below.

| Item | Regulations for personal effects | Regulations for commercial effects | Does DTDC provide this service? |

| Medicines |

|

|

Yes |

| Mobile phones & electronics |

|

|

Yes |

| Food items |

|

|

Yes |

| Clothes, Shoes & Cosmetics |

|

|

Yes |

| Alcohol, Plants & Pets |

|

|

Yes |

| Books |

|

|

Yes |

India-Specific Guidelines for Personal Effects Shipping

India has specific policies on the import of personal effects. Some of the common guidelines are:

- Must be in the owner’s use/possession for at least 1 year to qualify for duty concessions.

- Transfer of Residence (ToR) benefits apply if the owner has lived abroad for 2+ years and not stayed in India for more than 6 months in the past 2 years.

- Shipment must arrive within a specific period of the owner’s arrival (≈30 days for sea freight, 15 days for air freight).

- Non-compliance may lead to higher duties, charges, or denial of concessions.

- Some ports require the owner’s physical presence during clearance.

In addition to these, there are things that are prohibited or restricted from entry into India. You should be aware of these before shipping personal effects to India.

What You Can and Cannot Send in Personal Effects Shipping

Prohibited Items in Personal Effects Shipping

Certain goods are completely prohibited when shipping personal effects overseas to India. These include:

- Firearms

- Explosives

- Narcotics

- Counterfeit goods

- Items violating intellectual property laws

- Items with safety risks

Attempting to send these can result in confiscation, fines, or legal consequences. Always review the updated customs list before packing your shipment, or consult with your shipping provider.

Restricted Items in Personal Effects Shipping

Restricted goods can be shipped, although they must be pre-approved or have special permits. This category includes

- Alcohol

- High-priced electronics

- Some medicines

- Branded electronic equipment in huge numbers

The customs can categorise these items as commercial and not personal. Partnering with reputable personal effects shipping companies can assist you in keeping in line with customs regulations.

Cost of Shipping Personal Effects to India

Factors Affecting Personal Effects Shipping Cost

Shipping cost of personal effects is based on a number of factors, such as:

- Weight and volume

- Destination cities

- Port handling charges

- Local delivery charges

- Shipping mode (Air, Sea)

Insurance for shipping personal effects overseas is another factor that affects the shipping costs. Although optional, insurance guarantees that there will be no loss or damage during shipping.

Customs Duty for Personnel Effects that Exceed Duty-Free Allowance

For personnel effects that exceed the duty-free allowance, a customs duty is levied by the Indian customs authorities. This duty does vary based on the type of product, but generally, a 35% BCD is applicable. Additionally, a social welfare surcharge of 10% is also applicable.

Is There a Custom Duty on Laptops and Electronics Brought From India?

You will have to pay the import duty on used goods if the authorities determine the value of the goods to exceed AUD 1000. In such a scenario, your shipping partner can help you to legally avoid paying the customs duties. Contact our team to know more about this.

To better understand the costs involved in shipping, let us take an example.

Example of Personal Effects Shipping Cost

Consider an example of a personal effects shipping of 100 kg of household items, via sea shipment, between the U.S and Mumbai, which would cost between $400 and $700. The same shipment through air freight would cost over $1,500, but it would arrive in a few days.

Another reason for higher costs is opting for additional services provided by personal effects shipping companies, such as door-to-door service or professional packing. There are some tips that you can follow to reduce costs and avoid delays.

Tips to Avoid Delays and Reduce Costs in Personal Effects Shipping

Unexpected delays and increased costs do occur during shipping personal effects to India, but these can be mitigated by following some tips:

Document preparation in advance: Collect and maintain all the necessary documents well before the dispatch date.

Avoid prohibited and restricted items: Do not pack any prohibited items, as per Indian customs regulations. In the case of restricted items, ensure all the documents and conditions are satisfied.

Choose the appropriate shipping method: Opt for sea freight if the shipment is large, as it will save costs. And go for air transfer only if the shipping is urgent.

Gather information: It is useful to check community discussions on shipping personal effects internationally on platforms like Reddit to learn about the people who have recently shipped to India.

Consolidate shipments: Sending all the items in one large shipment is often cost and time-saving than sending them in multiple shipments.

Compare insurance plans: Personal effects shipping insurance comes in different types. Choose the plan only after comparing different types.

Partner with an experienced shipping company: Many aspects of the shipping process can be simplified by partnering with a professional shipping company. Make sure to partner with reputed providers like DTDC Australia to save on time and money.

What Happens If you don’t pay the Customs Duties

If the personnel effects go over the duty-free limit and the owner refuses to pay the customs duties, then the following actions can occur:

- Detention of Goods: The customs will detain the goods, and a detention letter will be issued.

- Option to Pay Later and Clear Goods: The owner can pay the duties at a later time, but extra storage charges will also be levied in this case.

- Confiscation and Disposal of Goods: If the duty is not paid within a specified period (generally 30 days), the customs can dispose of the goods through auctions.

- Penalties: Non-declaration or incorrectly declaring the duties can also lead to penalties in addition to the customs duties.

But if you are choosing DTDC Australia as your shipping partner, then you don’t have to worry about import duty on used goods and customs clearance, even if the value exceeds AUD 1000. Get in touch with our team to know more about this.

Storage Charges for Detained Baggage

The personal effects that are detained by the customs for non-payment of duties are stored in a customs-approved warehouse. Owners of the goods are responsible for paying the storage charges for the period that they remain in the storage area.

These charges are not levied by the customs authorities as they are not the custodian of the goods. Generally, the Airport Authority of India (AAI) is in charge of this or some designated warehouse operator.

A short free period of storage is usually given to the owner of the goods, which lasts for 24 to 48 hours. But after that, charges are levied based on the weight and area occupied by the goods. Payment of the storage charges is mandatory for clearance.

Role of Shipping Companies in Sending Personal Effects to India

The shipping companies that help with international shipping of personal effects simplify the relocation of belongings as they do the packing, transportation, and customs clearance. Using a reputable provider is advisable to guarantee that your goods arrive in India on time and without damage.

Customs clearance is one of the major hurdles in the shipment of personal items, and partnering with a reputed service provider can ease you through this process. One thing that you should keep in mind is that not every shipping company has the license to deal with personal effects.

So choose companies that have the license, such as DTDC Australia and save your time and money.

Ready to Ship Your Personal Effects to India?

Personal effects shipping to India does not have to be draining if you know how it works. Having the right documents, an understanding of the customs regulations, and planning will help you move your goods without any problems.

With DTDC Australia, you get expert support in customs clearance along with packing, documentation and delivery to India.