What is the HS tariff code for Australia? It seems like a simple question, but finding the answer is not easy. If you are an exporter or importer, you would know that even experienced ones often get caught in the complex web of HS tariff codes.

Whether you are starting your export business or sending an expensive package to your loved ones overseas, knowledge about HS codes gives you an advantage.

What Is an HS Tariff Code?

Before exploring the HS tariff codes for Australia, it is necessary to know about the HS code system.

What Is an HS Code?

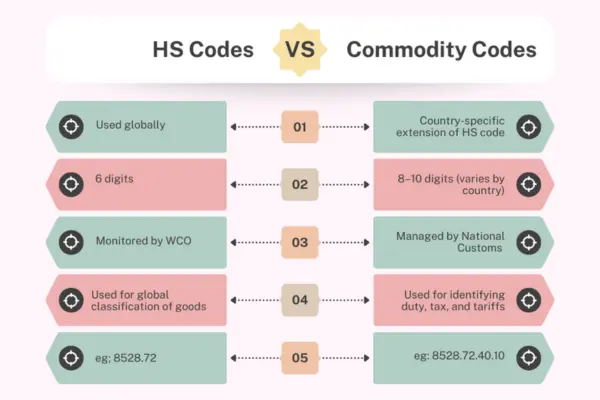

HS codes are 6-digit codes allocated to goods by the customs, where HS stands for Harmonized System. They are internationally recognized and help in identifying the taxes and other charges related to a particular good.

The system was developed by the World Customs Organization (WCO) in 1988. Managed by the Harmonized Systems Committee, the system undergoes updates every 5 to 6 years to be relevant to changes in international trade.

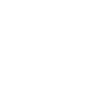

Countries may add extra digits to the HS codes to add details specific to the region. For instance, Australia uses two extra digits with HS codes, and they have different sets of commodity codes for imports and exports.

The latest update to the codes happened on January 1, 2022. Apart from being a regular revision, it also resulted in 350 amendments. The update also added new codes for products like drones and smartphones.

HS Tariff Codes

The HS code system was enforced in Australia by the Customs Tariff Act, 1995. In Australia, it is known as the HS tariff code with an additional two digits to identify the tariff rates and other allowances. It is a commodity code used by the Australian Customs Authority.

Australia has trade agreements with multiple countries, and by using the correct HS tariff codes, you can make use of the benefits of these agreements. HS tariff codes change depending on the country to which you are importing.

HS Tariff Code for Metal Furniture for Domestic Use

Why Do HS Tariff Codes Differ for Different Countries?

The HS system is used by nearly 200 countries, and in order to reduce the chances of errors, each country is given a separate code. Also, it helps to easily identify the countries with trade agreements with Australia and the type of agreement in place.

For example, the international HS code for men’s or boys’ shirts (of cotton) is 6205.20. For exporting the same clothing from Australia to the USA, the HS tariff code used is 6205.20.20, and for Australia to the UK, it is 6205.20.00.

Australian Harmonized Export Commodity Classification (AHECC)

Goods that are being exported from Australia need an AHECC code for export declaration. Being an extension of the international HS system, AHECC is another commodity code and has the same structure and hierarchy as the international HS system.

This code is mainly used for documentation purposes of the Australian customs and helps in classifying the commodities. You can refer to the Australian Bureau of Statistics website to find the AHECC code for your export goods.

Comparison of HS Codes and Commodity Codes

How To Look Up the Correct HS Tariff Code in Australia?

Multiple tools are available to look up the list of HS tariff codes for Australia, and the most trusted among them is the Free Trade Agreement (FTA) Portal. The portal is administered by the Department of Foreign Affairs and Trade (DFAT).

It is mentioned in the portal itself that the information is for general use, so it is highly recommended to get expert help and use the portal for awareness. With expert assistance, you can ensure customs clearance of your goods.

You can contact our team of expert custom brokers to learn more about this.

HS Tariff Code List of Australia

The list of HS tariff codes varies by product categories, and the chapter code helps in identifying the category of the product. If you want PDF files of the HS tariff codes list, then you can access them on the DFAT website.

A sample list of tariff codes of some of the popular product categories for export from Australia is given below.

| No | Category | Examples | HS tariff code |

| 1. | Mineral fuels, oils, and distillation products | Petroleum oils & oils from bituminous minerals | 2710.19 |

| 2. | Ores, slag, and ash | Iron ores & concentrates, non-agglomerated | 2601.11 |

| 3. | Gems, precious stones, metals, coins | Gold in semi‑manufactured forms, non-monetary | 7108.13 |

| 4. | Meat & edible meat offal | Meat of bovine animals, fresh or chilled | 0201.10 |

| 5. | Cereals | Wheat and meslin, other than seed quality | 1001.99 |

| 6. | Inorganic chemicals & precious-metal compounds | Precious-metal compounds & complex chemical compounds | 2843.20 |

| 7. | Machinery, nuclear reactors, boilers, and mechanical appliances | Steam or other vapor-generating boilers, plastic tube types | 8402.11 |

| 8. | Aluminium & articles thereof | Unwrought aluminium, not alloyed | 7601.10 |

| 9. | Copper & copper articles | Copper cathodes & sections of cathodes unwrought | 7403.11 |

| 10. | Electrical, electronic equipment | Electronic integrated circuits, processors & controllers | 8542.11 |

Where Are HS Codes Used in Documentation?

Whether you are exporting or importing, HS tariff codes being used in multiple components, like the package and documents. The appropriate HS tariff code is needed on the postage label while exporting.

Some of the common documents where tariff codes should be used are:

- Export declarations

- Customs declarations

- Commercial invoices

- Bills of lading.

Common Mistakes To Avoid

- Using an incomplete or outdated code: Always ensure that you are using the complete code, depending on the product and the country. Incomplete or outdated codes will face issues at customs.

- Taking code from other countries: Do not assume different countries have the same code for the same product. For instance, Australia has its own set of rules, and using anything else will result in incorrect code.

- Not considering product components: If the product is composed of multiple components, ensure that you consider the main use and composition while choosing the codes.

Don’t Guess – Learn and Seek Expert Advice

Commodity codes like HS tariff codes and AHECC are a must in the import and export business. Mistakes in their use can lead to huge losses, which can even affect the P&L of your business.

Make yourself aware of how the systems work, and partner with a reputable shipping service with experience in customs clearance, like DTDC Australia.

Our experienced team of customs brokers can help you identify the correct commodity codes and also tackle any other issues with customs. Get on a call with our expert to know more.

Frequently Asked Questions (FAQs)

What happens if you use the wrong HS code?

Usage of wrong codes can lead to delays, fines, penalties, and even seizure of your goods.

Does every product have an HS code?

Yes, every product is assigned an HS code, whether they are imported or exported.

Who provides the HS code?

The importer or exporter is legally required to declare the correct HS codes.

What is the difference between a commodity code and an HS code?

A commodity code is an extension of the HS code used for country-specific purposes. HS tariff code and AHECC are examples of commodity codes.